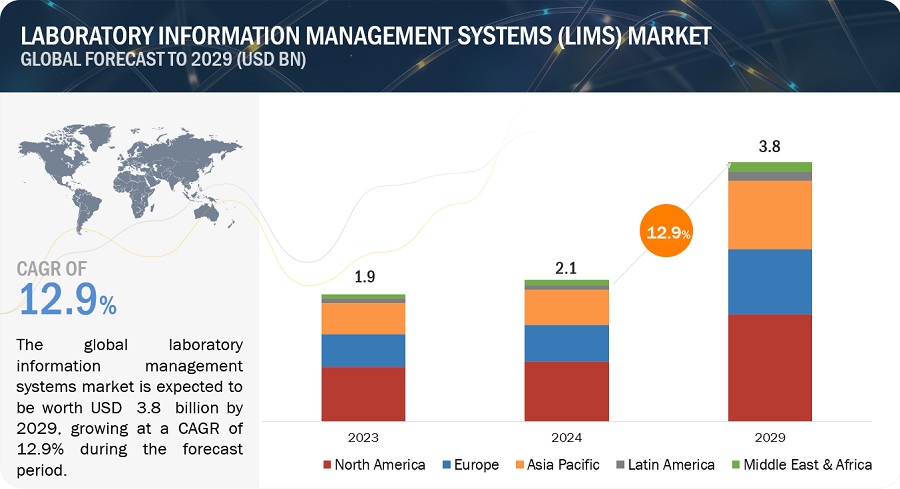

Laboratory Information Management System (LIMS) Market worth $3.8 billion by 2029

Laboratory Information Management System (LIMS) Market in terms of revenue was estimated to be worth $2.1 billion in 2024 and is poised to reach $3.8 billion by 2029, growing at a CAGR of 12.9% from 2024 to 2029 according to a new report by MarketsandMarkets™.

Laboratory Information Management System Market Trends

Download an Illustrative overview:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=250610373

Browse in-depth TOC on "Laboratory Information Management System (LIMS) Market"

200 - Tables

40 - Figures

400 - Pages

The cloud-based segment is expected to register a substantial growth in the Laboratory Information Management Systems (LIMS) market by deployment mode.

The Laboratory Information Management Systems (LIMS) market is segmented into on-premise LIMS, cloud LIMS, and remote-hosted LIMS. In 2023, the cloud-based segment is expected to register a substantial growth in the Laboratory Information Management Systems (LIMS) market, by deployment mode. It is driven by scalability, flexibility, and cost-effectiveness. The ability to adapt to changing workloads, reduced upfront investments, and lower maintenance costs make cloud solutions attractive to diverse laboratories. The accessibility and ease of remote data management meet the needs of a modern workforce, while enhanced security features address data protection and compliance concerns. As the industry prioritizes agility, cost efficiency, and data security, the growth of cloud-based deployment in LIMS is expected to continue.

The large companies segment holds substantial share in the Laboratory Information Management Systems (LIMS) market, by company size.

The Laboratory Information Management Systems (LIMS) market is segmented into large companies, mid companies, and small companies. In 2023, the large companies segment holds substantial share in the Laboratory Information Management Systems (LIMS) market, by company size. The large share of the segment is attributed to their scalability across multiple sites, comprehensive features for efficient data management and compliance, and ability to integrate with diverse laboratory instruments and enterprise systems, ensuring centralized control and enhanced collaboration. These factors collectively support improved efficiency, regulatory compliance, and ROI in large-scale laboratory operations.

North America dominated the laboratory information management system industry in 2023

The laboratory information management system market is segmented into five major regions- North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America accounted for the largest share of the Laboratory Information Management Systems (LIMS) market. This growth is propelled by factors such as the region's high per-capita healthcare expenditure, continuous innovation in laboratory technologies, and the integration of LIMS with Enterprise Resource Planning (ERP) and Clinical Decision Support (CDS) systems. The accessibility to advanced healthcare facilities and the increasing number of biobanks further contribute to the expanding LIMS market in North America. Additionally, the emphasis on quality control, regulatory compliance, and the adoption of digitization in laboratory processes are driving the demand for LIMS solutions in the region. Overall, the North American market's robust growth in the LIMS sector can be attributed to a combination of technological advancements, regulatory requirements, and the healthcare industry's evolving needs.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=250610373

Laboratory Information Management System (LIMS) Market Dynamics:

Drivers:

- Growing use of LIMS to comply with stringent regulatory requirements

Restraints:

- High maintenance and service costs

Opportunities:

- Growing use of LIMS in cannabis industry

Challenge:

- Dearth of trained professionals

Key Market Players of Laboratory Information Management System (LIMS) Industry:

LabWare (US), LabVantage Solutions Inc. (US), Thermo Fisher Scientific Inc. (US), Agilent Technologies (US), LabLynx, Inc. (US), Dassault Systèmes (France), Labworks LLC (US), Autoscribe Informatics (a wholly owned subsidiary of Autoscribe Limited) (US), Accelerated Technology Laboratories (ATL) (US), CloudLIMS (US), Computing Solutions, Inc. (US), GenoLogics Inc. (an Illumina Company) (Canada), Siemens (Germany), Novatek International (Canada), Ovation (US), Clinsys (US), Eusoft Ltd. (Italy), Caliber International (US), LABTrack (US), Agilab SAS (US), Agaram Technologies (India), and AssayNet Inc. (Canada), Blaze Systems Corporation (US), and LabLogic Systems Limited (UK).

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 38%, Tier 2: 45%, and Tier 3: 17%

- By Designation - C-level: 29%, Director-level: 44%, and Others: 27%

- By Region - North America: 42%, Asia Pacific: 21%, Europe: 28%, Latin America: 5% and Middle East & Africa: 4%

Laboratory Information Management System (LIMS) Market - Key Benefits of Buying the Report:

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (surge in LIMS adoption to meet stringent regulatory requirements, a heightened emphasis on enhancing laboratory efficiency, technological advancements offering sophisticated LIMS solutions, an increasing trend towards cloud-based LIMS adoption, and escalating R&D investments in pharmaceutical and biotechnology sectors), restraints (elevated maintenance and service costs, absence of standardized LIMS integration, challenges in interoperability, and limited uptake in small and medium-sized enterprises), opportunities (application of LIMS in the cannabis industry, the rising popularity of cloud-based solutions, and substantial growth potential in emerging markets), challenges (shortage of trained professionals and interfacing issues with informatics software) are factors contributing the growth of the LIMS market.

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, and new software launches in the Laboratory Information Management Systems (LIMS) market.

- Market Development: Comprehensive information on the lucrative emerging markets, type, component, deployment model, company size, industry, and region.

- Market Diversification: Exhaustive information about the software portfolios, growing geographies, recent developments, investments in the Laboratory Information Management Systems (LIMS) market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global Laboratory Information Management Systems (LIMS) Market.

Comments

Post a Comment